|

April is Fair Housing Month. RE/MAX Around Atlanta is committed to promoting and

supporting fair housing practices and equal access to housing for all individuals, regardless of their race, color, national origin, religion, sex, familial status, or disability. Fair housing is a fundamental human right, and we are dedicated to providing accurate and unbiased information that promotes fair housing practices. We are committed to providing access to resources and information that can help individuals understand their rights under fair housing laws and regulations. We support efforts to eliminate discrimination in housing and to promote fair housing opportunities for all individuals and will work to foster a communities where diversity and inclusion are celebrated and where everyone has an equal opportunity to access safe, decent, and affordable housing. The National Association of Realtors has produced an extremely informative, interactive simulation to train REALTORS® to deliver their services without discrimination. The following “Fairhaven” simulation is one of the best ways to learn to provide our services in a fair and non-discriminatory way. Please visit the town of Fairhaven and increase your knowledge and sensitivity to fair housing concerns. It takes about 1 hour to sell 4 homes and complete the simulation. Fairhaven is a town every REALTOR® should visit. NAR launched Fairhaven, https://fairhaven.realtor/home , in 2020, a new fair housing simulation training for REALTORS® that uses the power of storytelling to help members identify, prevent, and address discriminatory practices in real estate. Inspired by real stories, this innovative online experience has agents work against the clock to sell homes in the fictional town of Fairhaven, while confronting discrimination in the homebuying process. Learners will also walk in the shoes of a homebuyer facing discrimination. The training provides customized feedback that learners can apply to daily business interactions. Get started by visiting https://fairhaven.realtor/home to explore the fictional town of Fairhaven and assess how well you are adhering to fair housing principles. Please let us know how you liked the simulation by emailing us at [email protected].

0 Comments

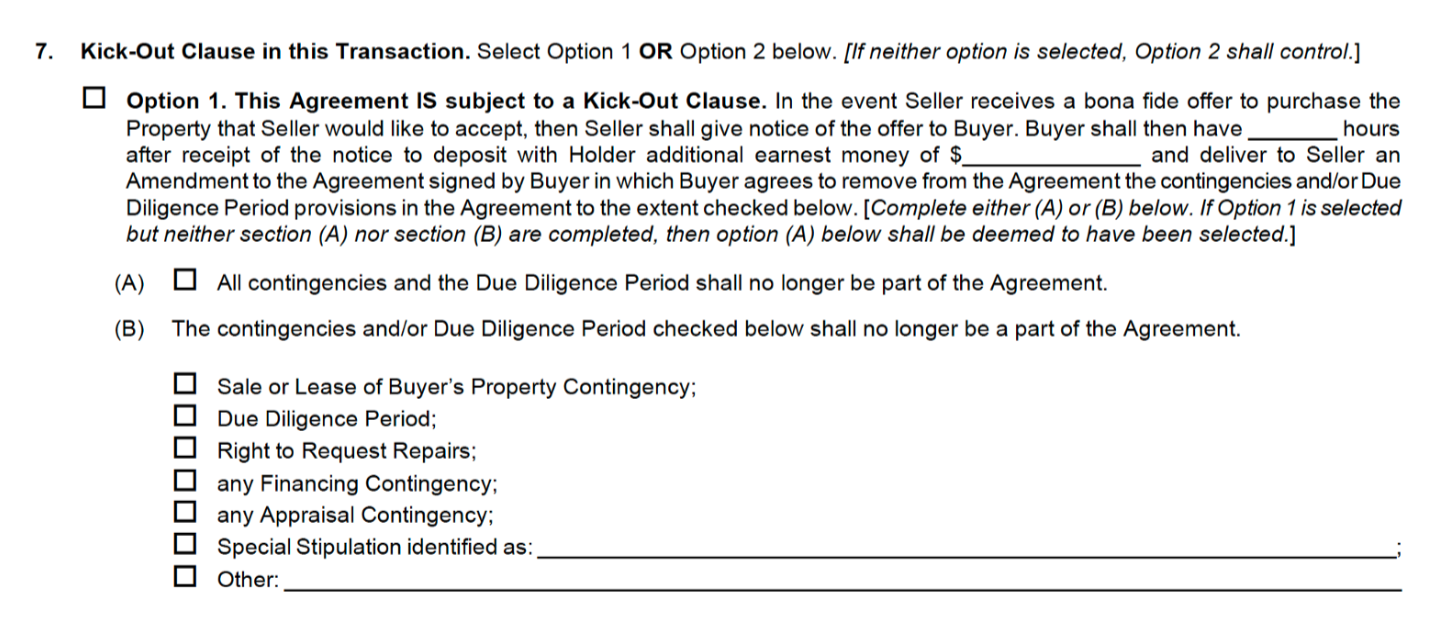

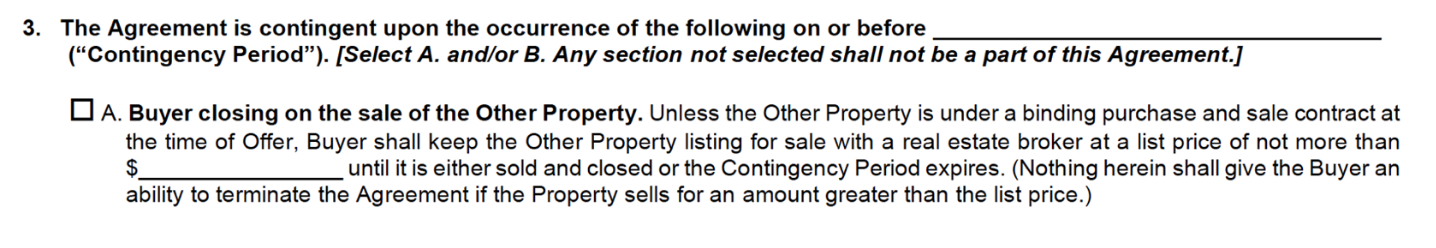

What is Home Title Fraud? Home title fraud is where a fraudster steals your home through identity theft and forging of documents. Then the fraudster either sells it or takes out a loan, especially HELOCs, against it without you even knowing about it. When the mortgage or HELOC is not paid, the property enters foreclosure. It doesn’t happen often, but it does happen. The loans are fraudulent, so the homeowner can eventually get the title back and the loans cancelled, but the hassle is real. Georgia’s Response Homeowners in Georgia have 2 alert systems to protect titles. They are not guaranteed, but they are good. If a homeowner doesn't have this alert tool, and something is filed in the county clerk's office against a homeowner’s property, the homeowner would not have the ability to react, often before it is too late. It works like alerts for suspicious spending on credit cards. Once the property is registered online with the county, the homeowner would get an alert any time someone tries to file something tied to that home. Whenever a property filing is recorded in a clerk’s office, registered users will receive an alert via email and/or text message. If the filing isn’t recognizable by the homeowner, they can contact the Clerk’s Office and local authorities. Opportunity to Connect with Your Database Most homeowners don’t know about this system. This is a great opportunity to send information about a strong tool of protection for homeowners. You can even go a step further by sending the parcel ID number to make the process even easier. Remember, the homeowner has to opt-in. Your clients will certainly appreciate it – and appreciate you. Here are the links. Fulton County In Fulton County, the Superior and Magistrate Court website has an online property fraud notification tool that is different from other counties, but performs the same function. The acronym R.E.A.A.C.T stands for Real Estate Activity Alert and Contact Tool. R.E.A.A.C.T. allows Fulton County property owners to register their properties with the court via parcel ID number. Anytime a document is filed against said property, the property owner will receive an alert giving them the opportunity to proceed as normal if they recognize it or to "react". This service is provided at NO COST to Fulton County Homeowners. Other Georgia Counties Other counties in Georgia use the FANS system, an acronym for Filing Activity Notification System. It has the same features as REACCT. It is a free, voluntary, opt-in program that can be used to send electronic notifications of filing activity to individuals who create notifications in the system. To access the system for all counties in Georgia, go to https://fans.gsccca.org and follow the prompts. Direct links to Atlanta core counties are below. DeKalb County https://registry.myfivepoint.com/dekalb/fraudreg/ Cobb County https://www.cobbsuperiorcourtclerk.com/real-estate-information/filing-activity- notification-system-fans/ Gwinnett County https://www.gwinnettcourts.com/deeds-and-land-records/filing-activity-notification- systems Forsyth County https://www.forsyth.cc/rod/property_fraud.aspx Fulton County https://apps.fultonclerk.org/reaact/MyAlerts The Sale or Lease of Property Contingency is quite flexible and can be used to either the buyer’s or the seller’s advantage, depending on the market and the situation. Part 1 of the discussion of the Sale or Lease of Property Contingency included various options or advantages available to the buyer and seller in the contingency as well as the process required to exercise the kick out clause. Drilling a bit deeper, the GAR form contemplates termination of a contingency contract in 2 ways: 1) Exercise of the Kick Out Clause and 2) Expiration of the Contingency Period. The Kick Out Clause Section 7 of the sale or lease contingency presents alternatives as to whether some or none of the contingencies in the contract remain in place. This can be confusing, so here’s the simple explanation by way of different scenarios. Scenario 1 Contract 1, fully executed, includes a sale or lease contingency with a 24 hour kick out clause. Contract 2, a bona fide offer, comes along and Seller wants to accept it, so Seller sends a 24-hour Notice to Buyer 1 to remove the Kick Out by amendment or Seller can terminate. Buyer 1 thinks the deal is great and that his current house will sell quickly, so, wanting to hold on to the house, Buyer 1 delivers an amendment to the Seller, agreeing to remove the contingencies and due diligence period that Buyer 1 agreed to in the original contract. In this case, the Buyer had agreed to section (A) in the purchase agreement, so the amendment says that all contingencies and the Due Diligence Period are removed from the contract. The sale becomes an all-cash transaction with the Buyer’s earnest money at risk. Scenario 2 In this scenario, the buyer chose alternative (B), but marked that only the Sale or Lease Contingency would be removed from the contract. The Due Diligence Period, the Right to Request Repairs, the Financing Contingency and the Appraisal Contingency are still in the contract. If timing is appropriate and the financing fails, the appraisal is low or there is still time to terminate in the Due Diligence Period, the buyer can still exercise his rights under those provisions. Had the seller marked additional provision in (B), that the Sale or Lease Contingency, the Due Diligence Period, the Right to Request Repairs and identified special stipulations would no longer be a part of the agreement, then only the finance and appraisal contingencies would remain a part of the agreement. Scenario 3 The Buyer cannot take the risk that the Existing Pending Contract will close n the Contingency Period. The Buyer does not respond with an amendment removing agreed contingencies. The Seller can terminate and accept Contract 2. Expiration of the Contingency Period Either with or without a Kick-Out included in the Sale or Lease Contingency, expiration of the Contingency Period automatically terminates the contract. Scenario

Buyer 1 has an outside date in the Sale or Lease Contingency by which their house must close or the contract terminates. That date is April 10, 2023. Buyer 2 has presented an offer with a back-up exhibit in their contract. The Seller really wants Contract 1 to close, but also does not want to lose Contract 2, so he either does not exercise his right to the Kick-Out provision or there is no Kick-Out provision. Seller agrees to Contract #2 with a back-up contingency. On April 11, 2023, at the expiration of the Contingency Period, Contract 1 automatically terminates. Seller sends appropriate notices and Contract 2 moves into Primary position. The Kick-Out was not necessary to terminate Contract 1. The termination was automatic after the Contingency Period expired. Reference: GAR F601, Sale or Lease of Buyer’s Property Contingency Exhibit April 12, 2023 The Sale or Lease of Property Contingency can be confusing, even to a seasoned professional. There are a lot of moving parts that need to be understood by both parties to properly draft this contingency. Each transaction is unique. The party that holds more power creating the sale or lease contingency really depends

on the market. In a seller’s market, sellers generally control and may make the contingency easy to for the seller to remove. In a buyer’s market, buyers generally control and may be able to avoid including a kick-out clause and make the time period to sell or lease as long as possible. The GAR Sale or Lease Contingency includes a lot of options for both buyers and sellers, making it flexible in both a sellers’ and a buyers’ market. Seller Options 1. If the property is not under contract already, the Buyer can be required to have the property listed for a price designed to maximize the likelihood of a sale or lease. If the property is already under contract, the seller will want to require a short time period for its closing. 2. Using a kick out clause, a seller can force the buyer to remove the contingency or even terminate the buyer’s contract if the seller receives another acceptable offer. There is a process in a kick-out clause, discussed below. 3. The seller can continue to market the property while there is a sale or lease contingency in place. 4. The Seller can negotiate to require that all remaining contingencies be removed and have the due diligence period end if the kick out is exercised, effectively making the contract an all-cash transaction. 5. If the buyer’s property was under contract when the contract was bound, but then terminates, the GAR contract allows a seller to terminate the contract. 6. If Buyer does not terminate the Agreement at the time of notice that the buyer’s contract has terminated, the Seller has the right, but not the obligation, to request that Buyer deliver an amendment signed by Buyer to remove all contingencies and Due Diligence Period from the Agreement. If Seller does not exercise this right within three (3) days from Buyer’s notice that Existing Pending Contract has terminated, then Seller’s right to request the amendment on this basis is waived. Buyer Options 1. The buyer can avoid termination via the kick out clause by removing the contingency. However, if the buyer does remove the contingency, the buyer cannot claim a failure of financing because the property didn’t sell. Careful here. 2. The buyer can convert some or all of the earnest money into non-refundable earnest money and keep the kick-out clause in place. 3. The time period for the buyer to close is a negotiated element of the deal. The buyer will want it longer. The Seller will want it shorter. 4. The Buyer can negotiate to leave contingencies other than the Sale or Lease contingency in place when the kick out clause is exercised. If the due diligence period, the financing contingency, any inspection contingency or other contingencies remain in place, the buyer still has protections. 5. If the buyer meets the pre-agreed requirements of the kick-out clause, then the original contract remains in force subject to the terms of amendment signed by both parties. 6. If the Existing Pending Contract is terminated and the buyer notifies the seller, Buyer has the right to terminate the Agreement at the same time of the notice without penalty. Meaning the buyer gets the earnest money refunded. The Process of Exercising the Kick Out Clause If the seller receives a better offer, and the seller exercises the kick-out, the seller notifies the buyer, and the buyer has a short time period to eliminate the agreed contingencies and the due diligence period from the contract making it an all-cash transaction. If the buyer does not agree to remove the agreed contingencies and the due diligence period, then the seller can terminate the contract and move forward with the better offer. Whether all contingencies and the due diligence period get removed or just some of the contingencies and the due diligence period is a matter of negotiation between the parties. The kick-out clause has been revised so that the parties can negotiate whether fewer than all of the contingencies must be removed if the kick-out is exercised or all of the contingencies must be removed. Buyers will obviously be pleased with the flexibility the form now provides. Part 2 next week. Reference: Weissman, Seth. The Red Book on Real Estate Contracts in Georgia (p. 729738). BookBaby. Kindle Edition. GAR F601 Sale or Lease of Buyer’s Property Exhibit Situation: Broker A has a valid Buyer Brokerage Agreement with an individual Buyer. Broker A and the Buyer view a property together with Broker B, representing the Seller. The Buyer submits an offer on the property, but withdraws it before the offer is accepted. Later, while the Buyer Brokerage Agreement is still in effect, Buyer crates an LLC with a partner and submits a 2nd offer to purchase the same property. The Buyer’s Broker is not included in the new transaction. The transaction closes with the new LLC, of which the Buyer is a Member. The Buyer is at the closing and signs the security deed. Questions:

Buyer as a Legal Entity and Commission Owed to Buyer’s Broker The Buyer Brokerage Agreement at paragraph 7(f) includes the Buyer as follows: "Any legal entity in which buyer or any member of Buyer's immediate family owns or controls, directly or indirectly, more than ten percent (10%) of the shares or interest." Where the buyer changes its legal entity to another either to avoid its obligation or innocently, the Buyer is still obligated on a Buyer Brokerage Agreement that is still in effect. No, the Buyer cannot avoid its obligation to the Buyer’s Broker by changing its legal entity so long as the Buyer owns more than 10%. And yes, the Buyer continues to owe a commission to the Buyer’s Agent. It may take legal action to recover the commission, but it is owed. The Listing Agent’s Obligations REALTORS® have an affirmative obligation to ask prospects whether they are a party to any exclusive representation agreement and may not knowingly provide substantive services concerning a prospective transaction to prospects who are parties to exclusive representation agreements. In this case, the Seller’s agent was fully aware of the original buyer, having shown the property to the buyer previously, along with the Buyer’s agent. Even if the Seller’s agent thought the Buyer Brokerage has expired or was terminated, the listing agent should have investigated. Had he called the Buyer’s agent he would have learned that the Buyer Brokerage was still in effect. He violated both Georgia License Law and the REALTORS® Code of Ethics. (GA Code § 43-40-25 (14) and § 43-40-25 (26), REALTORS® Code of Ethics Standard of Practice 16-9) |

RMAAReal Estate News, Brokers Blog & More Categories

All

Archives

July 2024

|

RSS Feed

RSS Feed