|

- by Mark Moore

Appraisals are interesting right now! We just hosted a great lunch and learn at the Sandy Springs office, and here are a few key takeaways. 1. With so many homes not making it into FMLS or MLS, one of the most important things you can provide to an appraiser is any recent sales that were not in the MLS/FMLS system that have closed or are scheduled to close. They need two sources of data to verify. 2. Appraisers have to “bracket the subject property”. One higher priced, one lower priced. One slightly larger, one slightly smaller. It’s very hard to do with the rate homes have been appreciating. 3. If you are providing comps, they need to be recent (last 3 months), close to subject property, and similar in size, design, finish, etc. 4. Gross living area (GLA) is one of the most important factors to an appraisal. Area below grade (even if daylight on 3 sides) is not allowed to be counted in the GLA of a home. Ideally, the appraiser would find a comp with similar above and below grade square footage. But they can’t comp a 5000 s/f home with 2500ft in a basement, to a 5000 s/f home on a slab where all the living area is above grade. 5. There is a difference in quality of appraisers. Be sure your lender is using top quality appraisers; it will save your clients and you much stress and work! We are happy to answer any further questions from any of you who could not attend! J Just email or call us!

0 Comments

Recent findings from MBA SVP & Chief Economist, Mike Fratantoni, indicate that the talks about interest rates going up are beginning. See his comments below:

“Longer term interest rates, including mortgage rates, jumped earlier this year as vaccinations began and the government pushed more fiscal stimulus into the economy. In the past few months, mortgage rates have moved within a very narrow range. While the Fed has not yet laid out specific plans with respect to tapering their Treasury and MBS purchases, the changes in the forecasts for the economy, and for their rate target, suggest that tapering is close at hand. As a result, mortgage rates are likely primed to move at least somewhat higher.” Mike Fratantoni, MBA SVP & Chief Economist. Rates have been so good for over a year now and we all know that they have to go up at some point. It seems that earlier forecasts that called for rates to be in the upper 3’s by the end of the year may still hold true. Only time will tell, but for all the agents out there, the time to buy and sell is right now. by Mark Moore with Fairway Mortgage

The “appraisal gap” as it’s becoming known, is a real issue with the lack of homes and so many buyers. Multiple offers are commonplace and so are bidding wars. Even good appraisers who know the market and understand the actual definition of fair market value are struggling to come up with comparable sales that meet the criteria of the agencies (Fannie, Freddie, FHA, etc). Now more than ever, current market data provided to the appraisers can help. Be sure you have copies available of the multiple offers on your listings, and let the lender know that you have them and are willing to provide to the appraiser. Also, any recent market information you have that the appraiser might not know about can help. For example, do the realtors involved know of a similar property that has just closed in the last week or is scheduled to close just before the subject property? If so, providing that information is another way to help appraisers get the value in this tough market. Fairway uses a very small rotations of quality appraisers in each area of town. We attempt to provide enough work to those appraisers to become important to them. They are a very important part of our team and critical to our success and are graded on accuracy, timeliness, and other factors to determine which appraisers make it into our “elite rotation”. As a result, we have had very few appraisal issues during this market, and we have become the “bailout” lender for many of the big banks, credit unions, and internet lenders who do not use such a strategy. However, with the market pressures (everyone asking for faster and faster appraisal contingencies) this can sometimes force us off the elite panel and into a less trusted group of appraisers to meet the ever-shortening time frames. If you have a good offer, with a solid local lender, encourage your sellers to give that lender time to get a quality appraiser out to the property. It will create much less stress and hassle down the road! Faster isn’t always better!! If you have further questions about this or anything else, we are happy to assist. Interest rates are up! If you haven’t heard interest rates over the last few weeks have popped up into the low – mid 3% range for a conventional 30 year fixed with good credit. Of course, you can still pay points to buy the rate back into the upper 2’s but help your clients that pre-approved 3+ weeks ago know that this was a market move. I do think that rates moved a little fast and I wouldn’t be surprised if we see a bit of a pullback over the next week or two. But the general trend is a slow increase throughout the rest of 2021 with rates predicted to end the year in the upper 3’s. We are going to host a 15-30 minute Zoom meeting next week to talk more about rates, where I think they are heading, and what to expect for the Spring market. Be sure to sign up!

Hi, everyone! Welcome to 2021!

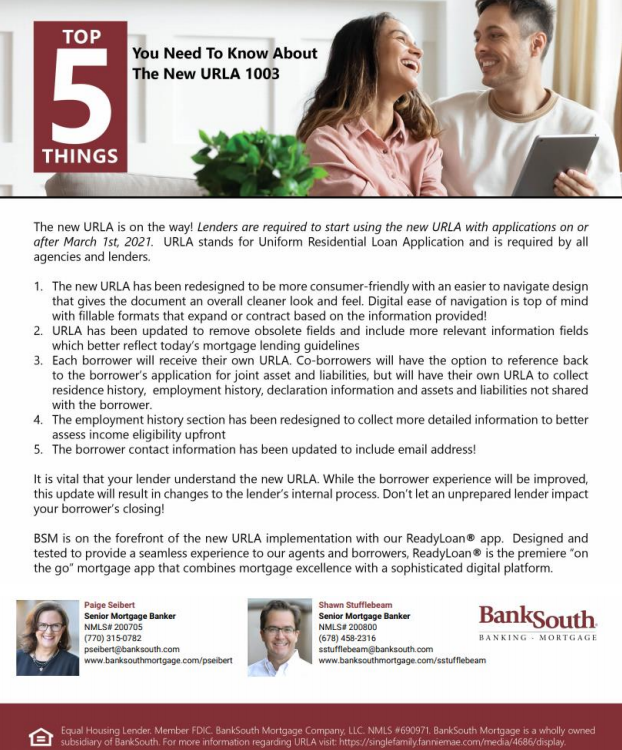

One big change that was just announced that you need to be aware of is regarding obtaining Power of Attorney (POA) for your buyers. Beginning on January 4 th , Freddie Mac no longer allows buyers to get a POA except in the event of a medical emergency. Fannie Mae has not updated their policy, so for the moment they still allow POA’s with all the previous stipulations, but they could follow suit. POA’s have been progressively more difficult since the great recession. The agencies (Fannie and Freddie) don’t like them. So if you have buyers who are talking about “not coming to closing,” you need to let your lenders know immediately. A POA may not be an option, so the buyers may have to attend, or arrange a mail away. This change does not affect POA’s for sellers, so for your listings you are in good shape. Remember, a “conventional loan” just means the loan is either going through Fannie Mae or Freddie Mac. Some lenders use one or the other, and some use both (our company Fairway sells directly to both). However, if you happen to have a buyer who is dealing with a lender that only runs loans through Freddie Mac, then that lender will no longer be able to allow POA’s at all for conventional loans. If you have any questions on this or want to discuss the topic further, please give us a call at 404-373-3411 or email us at [email protected]. As a reminder, the new conventional loan limit for Georgia is now $548,250! Happy New Year! A question we get asked a LOT is “how long will rates stay low?”. Obviously, if I knew the exact answer to that question, I wouldn’t be writing this article for all of you fine folks! I would be on my private island in the Bahamas or Tahiti sipping on a frozen concoction from a coconut with a little paper umbrella! J But there are some predictions and I thought it would be helpful for you to have this knowledge for your clients. First off, the election (if we ever finish this) should not have any immediate impact on rates. The COVID stimulus package that everyone thought was coming before congress left, didn’t happen and since they won’t all be back until mid-November, rates should stay pretty stable until at least then. If a big stimulus package is passed that could put upward pressure on interest rates, but it would only move them a little bit. The big thing that will start to cause rates to move upward will be a viable COVID-19 vaccine. When that happens, and people in the hardest hit industries can start returning to work and things start to return to normal, I would expect rates to start a more noticeable rise.

Rates are being kept artificially low right now because the Federal Reserve is buying up Mortgage Backed Securities (MBS) to create artificial demand and drive rates lower. This was a strategy to help the economy weather the COVID storm. But as soon as a vaccine looks to be in place for most Americans, and we start to see growth again, the Fed is likely to stop this policy and let the free market take over again, which will cause rates to rise. No one knows exactly when that will be, but as you are advising your clients, let them know that any signs of vaccines working and begin distributed will most likely be followed by rising interest rates. The best predictions we have right now is that rates will stay in the upper 2%’s range (30 year fixed) for the remainder of 2020 and will slowly begin to climb in the late first quarter or early second quarter of 2021. The predictions show them ending 2021 in the upper 3’s. Obviously, no one KNOWS what will happen, but this seems to be the current consensus. Thanks and Happy Thanksgiving to each of you and your families! |

RMAAReal Estate News, Brokers Blog & More Categories

All

Archives

July 2024

|

RSS Feed

RSS Feed