|

The Federal Housing Administration (FHA) was created by the federal government to provide mortgage lenders with insurance against losses if a borrower defaults on a loan. FHA is not actually the lender. FHA is really an insurance company that eliminates the lender’s risk so lenders will make loans to borrowers that they might otherwise deny.

Borrowers like FHA insured loans because of relaxed credit and income ratios , lowered down payments and less cash to close. Sometimes a buyer that can’t qualify for a conventional loan will want to switch to an FHA insured loan. Should a Seller allow a Buyer to switch to an FHA loan? First, a buyer that includes a conventional loan contingency in a contract cannot switch to an FHA insured loan (or VA or USDA) without an amendment to the contract. That is, the Seller has to agree. Next, there are substantial differences in the Seller’s position if the seller agrees to an FHA loan. A simple financing contingency that expires quickly can become a valid termination right before closing day. Amendatory Clause and Repairs Clause The FHA loan contingency offers protections to a borrower, required by FHA regulations, that are not found in a conventional loan, specifically, the Amendatory or appraisal and repairs clauses. According to the FHA, operation of these clauses, cannot be eliminated. Even if the finance period has expired, the contract can still be terminated due to a low appraisal or a failure to agree to repairs. For that reason, some Sellers won’t accept an FHA insured loan contingency. Termination due to appraisal or repair issues can happen right up to closing day, even if buyer has the ability to obtain the loan. Here’s an example: A contract has an FHA loan contingency with 21 days from the binding date to determine if Buyer has the ability to obtain the Loan. The 21 days has expired and the buyer has the ability to obtain the loan. However, the appraisal comes in low. According to the Amendatory Clause in the FHA Loan contingency (paragraph 11), the Buyer can terminate and the Buyer gets the earnest money back. The Buyer can decide to close, but it’s the Buyer’s choice. There are, of course, ways that the parties can negotiate if the buyer and the seller want to negotiate. The Seller can reduce the purchase price or the buyer could pay the difference to the contract price or anything in between. But if the appraised price is lower than the minimum value in the contingency and the Buyer wants to terminate, the buyer can terminate and will get the earnest money back. Here’s a second example: The same facts as above, but the appraised price is not an issue. Instead, the appraisal includes certain required repairs to the property that exceed the amount the Seller has agreed to pay in paragraph 15. According to paragraph 15 (Repairs), if the costs of repair exceed the amount agreed, 1) the Seller has to provide written statement of the repair cost and 2) the Buyer and Seller have 3 days to negotiate and agree. If they don’t come to an agreement, the contract automatically terminates. No one is in default. The earnest money goes back to the buyer. Conventional Loan Compare this situation to a conventional loan contingency. The ability to obtain a loan and the appraisal contingency have expired. It’s simply a cash deal now. The buyer can bring loan proceeds to closing, but if the buyer does not and does not have the cash to close, the buyer is in default and the buyer’s earnest money is forfeited to the seller. Investigate the Situation So, what if your seller is faced with a contract that includes a FHA loan contingency or a buyer that wants to switch from a conventional loan to an FHA loan? Our recommendation would be to investigate before agreeing. Is the appraisal going to meet the price? Are repairs going to be an issue? If the FHA loan looks good and the appraisal and repair issues look good, then it’s reasonable to agree. If a buyer is asking to switch to an FHA loan. get some answers before agreeing.

2 Comments

Prior inspection reports typically come up from a deal that didn’t go through. A good report can bolster a property’s value, but a bad report can hurt. The question often asked,

“Do I have to provide a bad report to subsequent buyers?” The bottom line answer is YES. Prior reports constitute material facts. A seller's duty to disclose his knowledge of defects does not end when he completes a written Seller Property Disclosure. A seller's knowledge includes prior inspection reports obtained by previous buyers. Sellers have an ongoing duty to disclose any defects revealed in those reports. The Brokerage Relationships in Real Estate Transactions Act (“BRRETA”) is the Georgia consumer protection state statute that governs the relationship between real estate brokers and real estate consumers. Regarding a Broker’s duties to other parties, BRETTA states the following: A broker engaged by a seller must disclose all the following to all parties with whom the broker is working: All adverse material facts pertaining to the physical condition of the property and improvements located on such property including but not limited to material defects in the property, environmental contamination, and facts required by statute or regulation to be disclosed which are actually known by the broker which could not be discovered by a reasonably diligent inspection of the property by the buyer. Seth Weissman, attorney at Weissman PC and general counsel for Georgia REALTORS®, in his Safe Real Estate Series, covers 4 Listing Agent scenarios:

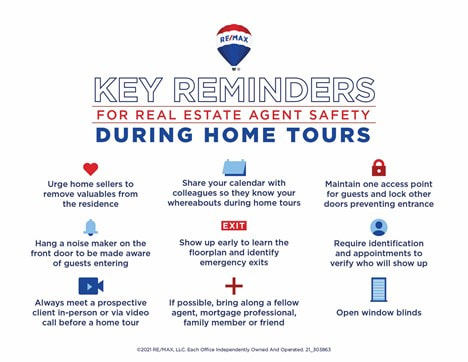

So, now you know, you have to disclose the bad report. Consider a few courses of action: Get a new report that neutralizes the bad report. Or, if that is not a possibility, the seller should consider repairing the defects. Or, consider adjusting the price to reflect the defects. Always weigh on the side of disclosure, regardless of how much it might hurt. Prior inspection reports constitute material facts concerning the property which a purchaser is entitled to know in making the decision whether to buy the property. September is Agent Safety Month. For many agents – new and tenured alike – safety protocols aren’t top of mind, especially in a busy market with new opportunities and prospective clients popping up daily. Here are some simple safety precautions real estate professionals can take during home tours and open houses. Verify Who You’re Meeting Take initial meetings with clients outside of a home setting. Meet clients first in places like a coffee shop or in the office. Verifying the identity – and intentions – of each and every prospective client is a relatively simple precaution real estate professionals can take. Be aware, everywhere

(GAR FORM F316 AND GAR FORM F918) The Lead-Based Paint Exhibit was revised in April to create an exhibit exclusively for sales transactions (GAR F316) and another one for lease transactions (GAR F918). As such, the new exhibits track more closely the federal forms prepared by the Environmental Protection Agency. Both forms now include boldface disclosures explaining that prior to the contract becoming a binding agreement, the lead-based paint exhibit needs to be completed by the buyer and seller and the buyer needs to receive a lead-based paint brochure.

What is covered by the Federal Rule? The Residential Lead-Based Paint Hazard Reduction Act of 1992, also known as Title X, directs HUD and EPA to require the disclosure of known information on lead-based paint and lead-based paint hazards before the sale or lease of most housing built before 1978. Lead Based Paint Hazards can include fixtures that were built prior to 1978, even though the property itself was built after 1978. Think about antique doors, antique light fixtures or any other elements in the property that may have been created prior to 1978. If in doubt, disclose. What is Required and When? Before a Purchase Agreement or a Lease becomes binding, federal law requires the following:

Compliance is Easy If you represent the Seller, the easiest way to comply with the requirements is for the Listing Broker to have the Seller complete the Exhibit at listing (along with the Seller Property Disclosure and the Community Association Disclosure). The Listing Agent can distribute it 2 ways: 1) have it in the property for agents to pick up and 2) upload it to FMLS /and GAMLS. The Exhibit can then be downloaded by the Buyer’s agent to sign before an offer is made. Remember, the requirement is that the LBP Exhibit be executed by both parties prior to a binding agreement. If you represent the Buyer, make it a habit to include "Protect Your Family From Lead In Your Home" GAR CB 04, along with Protect Yourself When Buying a House, with every Brokerage Agreement. Be sure to check it as provided to the Buyer in the Brochures section of the Buyer Brokerage Agreement, so you can prove that it was delivered. (And avoid a big fine.) What boxes should be initialed? Seller:

Buyer:

What if a contract is not in compliance? The law carries huge fines for violations. Each violation carries a fine from $11,000 to $16,0000. Assume that investigators from the EPA are here in Georgia, spot checking for violations. Because they definitely are here. It’s the Law Don’t procrastinate and don’t let the Seller push back. The LBP disclosure is a mandatory federal law. It is not optional. A Special Stipulation is a specific instruction written in a contract that is unique to the buyer and this seller. It is not a place to reiterate what is already in the contract. In the GAR Purchase and Sale Agreement (PSA), if there is a conflict between a Special Stipulation and any exhibit, addendum, or preceding paragraph, including any changes made by the parties, the Special Stipulation controls.

The Critical 5 elements: Who, What, When, How and Remedy. The rules for writing Special Stipulations are simple. Include the critical 5 elements and you will have written a solid Special Stipulation. Below are 2 appraisal Special Stipulations. One is missing the critical “Remedy” element. The other includes a remedy and is complete. Missing Remedy Element Example In the event the Property does not appraise for at least the purchase price, Buyer shall pay the difference between the appraised price of the Property and the purchase price of the Property in cash at closing, provided that the amount does not exceed the sum of $ 10,000. 1.Who is going to do it? The Buyer. 2.What are they doing? Paying the difference, limited to $10,000. 3.When will it be done? At closing. 4.How is it going to be done? In cash. 5. Remedy if the Special Stipulation doesn’t work? There is no remedy! The Buyer and the Seller will either have to negotiate to save the deal or the contract will fail for being too vague to enforce. If one of the parties wants it to fail, it will fail. Complete Special Stipulation In the event the Property does not appraise for at least the purchase price, Buyer shall pay the difference between the appraised price of the Property and the purchase price of the Property in cash at closing, provided that the amount does not exceed the sum of $ 10,000. Notwithstanding the above, if the difference between the sales price and the appraised value of the Property is more than $10,000, Buyer shall have the right, but not the obligation, to terminate this Agreement provided that Buyer gives notice to Seller within 3 days of receiving the appraisal of the Property, in which case Buyer shall be entitled to the return of Buyer’s earnest money. If Buyer does not terminate the Agreement within this time frame, Buyer’s right to terminate on this basis shall be waived and Buyer shall pay cash to Seller at the closing for the entire difference between the appraised value and the sales price of the Property. 1.Who is going to do it? The Buyer. 2.What are they doing? Paying the difference, limited to $10,000. 3. When will it be done? At closing. 4.How is it going to be done? In cash. 5. Remedy if the Special Stipulation doesn’t work? If the difference is greater than $10,000, the Buyer can terminate or the buyer’s right to terminate is waived.The complete Special Stipulation appraisal is not vague. It allows the contract to proceed according to its terms. Hope this helps! |

RMAAReal Estate News, Brokers Blog & More Categories

All

Archives

July 2024

|

RSS Feed

RSS Feed