|

Acceptance requires both a written acceptance and delivery.

The GAR Purchase and Sale Agreement requires that an offer (or a counteroffer) be both 1) accepted in writing and 2) delivery back to the offeror, prior to the expiration of the time limit of the offer, to be effective. For example, suppose the Time Limit of an Offer is 12:00 pm on May 1. The Seller accepts the offer through Remine at exactly 12:00 pm on May 1, but the accepted offer is not delivered to the Buyer until 12:01 pm. Is there an agreement? According to the provisions of the GAR Purchase Agreement, the answer is no. The acceptance was delivered after the expiration of the time limit. Of course, the parties can agree to accept by sending a binding date confirmation, an amendment or even a Reinstatement of Contract, but the party that set the time limit can also decide to back out. In this very hot Seller’s market, these things really happen. Consider the opposite situation. The Seller sends a counteroffer to the buyer. In the meantime, the seller receives a better offer. The Seller can’t act on the new offer, because the counteroffer is in play until 12:00 pm. The Buyer signs at 12:00, but the agent does not deliver the acceptance until 12:01 pm. Is there an agreement? No. The Seller is free to accept a different offer. Withdrawal of the Counteroffer. An alternative to the above example is that, if the seller receives a new offer that the seller wants to accept (while the time period for acceptance by the first buyer is still open) the seller can withdraw the counteroffer to the 1st buyer prior to the 1st buyer signing. Once it is properly withdrawn, the seller is free to accept a new offer. The requirement of delivery of an acceptance is covered in 3 different places in the GAR Purchase and Sale Agreement: 1) Time Limit of Offer, 2) Delivery of Notice and 3) Notice of Binding Agreement. It is also covered in the Counteroffer language at the bottom of page 1. Remine tracks and time stamps. Remine tracks and time stamps each signature and delivery of documents. To conform times in Remine, select the Audit Report and the time stamp information can be downloaded. A late acceptance is a counteroffer. When an express time limit is included in a contract, but the offer is not accepted within the time limit, no agreement is formed. If, however, the offer is accepted at a later time, it is generally considered a counteroffer that the original offeror can accept or not.

0 Comments

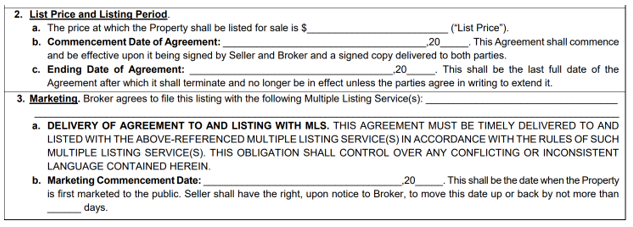

There is a lot of confusion regarding the new FMLS “Marketing Commencement Date” and the “Coming Soon” status. They are 2 separate policies, though they can be used together. Marketing Commencement Date The newest iteration of the Exclusive Seller Brokerage Engagement (GAR F101), added on April 15, 2021, separates the Listing Period from Marketing to avoid the confusion that has existed. The Start Date and the End Date of the Listing Period are clearly separated from Marketing. Section 3 is the Marketing portion and includes the Marketing Commencement Date and a time period for adjustment of that date by the Seller. If Marketing Commencement is the same date as the Start Date of the Listing, insert the start date. If it is later, insert the later date. The ability of the Seller to adjust the date allows for changes to Seller or property readiness. It can be completed with a zero or any number of days. Prior to the Marketing Commencement Date, during the delay period, it is “off market” and is not seen by anyone. (Versus the Coming Soon period.) The Marketing Commencement Date can be as far away from the Starting Date or Listing Commencement Date as the Ending date. It is limited only by the expiration date of the listing. In theory, the property can sold, but never be marketed If the listing was Exclusive, however, and even it never goes into FMLS, a fee is still due to FMLS.

Practice tip: It is recommended that the Listing Period be measured from the date of the commencement of marketing., rather than the start date of the listing. If it takes a month or more to get the property ready for sale, valuable time is lost by measuring from the List Date. You want your listing period to be the maximum time for marketing and not wasted on a preparation period. "Coming Soon" "Coming Soon" is also an "off-market” status, but is very different from a delayed Marketing Commencement. "Coming Soon" properties CAN be seen by FMLS members who are logged into Matrix, but are not distributed to agents, public or syndication websites, including GeorgiaOpenHouses.com, ShowingTime, or the Matrix Consumer Portal. Properties listed as "Coming Soon" are limited to a period of 21 days prior to going active. At midnight of the Go Active date, when the 21-day period ends, Matrix automatically changes the listing status to Active. You can, of course, change the status to Active prior to that date. You must include a Go Active date when entering the listing under the "Coming Soon" listing status. No Marketing to the Public under “Coming Soon” A property under “Coming Soon” cannot be marketed to the public in any manner. Marketing of the property to the public includes, but is not limited to, flyers displayed in windows, yard signs, digital marketing on public facing websites, brokerage website displays (including IDX and VOW), digital communications marketing (email blasts), multi-brokerage listing sharing networks and applications available to the general public. There is a marketing exception for the “Coming Soon” status. Internal marketing that only goes to other licensees within the Seller’s Broker’s firm is not considered public marketing unless it is distributed to licensees outside of the brokerage firm. A listing that was under the "Coming Soon" status cannot be extended beyond 21 days or re-listed as “Coming Soon” unless it has been off-market for 90+ days. DEFINITION OF SECURITY DEPOSIT

The term "security deposit" refers to money or other valuable items given by a tenant to a landlord in conjunction with renting property and can include damage deposits, advance rent deposits, and some pet deposits. If the landlord charges the tenant a nonrefundable fee such as a cleaning fee or a pet fee, the nonrefundable fee is not part of the security deposit. The security deposit protects the landlord against losses from default in rent payment and from losses due to the tenant's negligent behavior in relation to the landlord's property. Security deposits are not a source of funds for the repair of damages to the property that result from normal wear and tear. Typically, the security deposit is a fund established by the tenant to guarantee faithful performance of the tenant’s obligations incurred under the lease with regard to the property and to mitigate any losses by the landlord. This interpretation entitles the tenant to a return of the security deposit at the end of the lease if the tenant meets their obligations. If no damages occur due to negligence by the tenant, the tenant receives the entire deposit. Disagreement can arise, however, about what is damage resulting from negligent behavior and what is normal wear and tear. For example, wear and fraying of carpeting may be a consequence of normal wear and tear, whereas rips and discoloration from spills may be the result of the tenant's negligent behavior. The "move-in, move-out inspection form" can head off potential disputes over responsibility for damages to the property. ESCROW ACCOUNTS FOR SECURITY DEPOSITS Under Georgia law if a person individually or collectively owns with his or her spouse and/or minor children more than ten residential rental units, the Georgia law has stringent requirements for collecting and handling security deposits. When the landlord owns more than ten units, the landlord must place all security deposits in an escrow account to hold them in trust for the tenants during the tenancy. These requirements also apply whenever third persons (agents) manage rental property for a fee, whether or not the owner owns more than ten units. MOVE IN AND MOVE OUT INSPECTIONS Move In: Before accepting a security deposit on residential property, the landlord must give the tenant a list of all existing damages to the premises and allow the tenant to inspect the premises to ensure the accuracy of the list. In practice, most brokers give tenants a GAR move-in, move-out inspection form for the tenant to fill out. Once the tenant and landlord agree upon the condition of the items listed on the form, both must sign it; and it serves as evidence of all known defects to the property at the beginning of the lease. If the tenant refuses to sign the list, the tenant must state specifically in writing the items on the list to which he or she dissents and sign such statement of dissent. Move Out: Within three days after the date of the termination of occupancy, the landlord must (a) use the original inspection list to determine if any additional damage has occurred during the tenancy; (b) determine the estimated dollar value of such damage to charge against the tenant's security deposit; and (c) notify the tenant in writing. The tenant has the right to inspect the property within five business days after the termination of occupancy in order to ascertain the accuracy of the list of damages. Both parties sign a statement indicating their agreement on the final damage assessment. If they cannot come to an agreement over the damages, the tenant must specifically state in writing the items on the landlord's list to which he or she dissents and must sign that statement of dissent. If the tenant vacates the property without notifying the landlord, the landlord's final inspection may come within three days after the landlord discovers the termination of the occupancy. Treble Damages Possible: When the parties cannot come to an agreement over the damages, then the tenant may institute a legal action in any court of competent jurisdiction against the landlord for the amount of the security deposit that the tenant believes was wrongfully withheld. If the tenant prevails, the landlord can be liable for up to three times the improperly held deposit plus attorney's fees. RETURN OF RESIDENTIAL SECURITY DEPOSITS The landlord must return the security deposit within thirty days after the termination of the rental agreement or the surrender and acceptance of the premises, whichever occurs later. A landlord may not withhold a security deposit for ordinary wear and tear of the premises. If the landlord retains any portion of the security deposit, the landlord must provide the tenant with a written statement listing the exact reasons for doing so. If the landlord retains the deposit to pay for repairs of damages to the premises, the landlord must list the damages. Upon delivering the written statement to the tenant, the landlord must accompany it with a payment of the difference between any sum deposited and the amount retained. The landlord may mail the statement and any payment required to the last known address of the tenant by first class mail. If the letter containing the payment is returned to the landlord undelivered and the landlord is unable to locate the tenant after reasonable effort, the payment will become the property of the landlord ninety days after mailing. In addition to compensation for damages, the landlord may also lawfully retain amounts from the security deposit for mitigating damages caused by nonpayment of rent or of fees for late payment, unpaid utility charges, cleaning charges, or other damages caused by a tenant's breach of contract. The landlord must give notice to the tenant and use the funds specifically for those purposes. If the landlord fails to return the security deposit or fails to comply with the special legal requirements, the landlord forfeits all rights to retain any of the funds in escrow, forfeits the right to sue the tenant for damages to the premises, and can become liable to the tenant for three times the amount withheld plus reasonable attorney's fees. If the damages to the property exceed the amount of the security deposit, the property owner can sue the tenant for the additional funds to fix the damage. Unpaid rent amounts and late fees can be included in this suit. If a financing contingency has ended without a Buyer terminating, the GAR Conventional Finance Contingency VA and FHA exhibits all give the Seller the right to demand evidence confirming the Buyer has funds or a loan commitment to close. After a demand by the Seller, the Buyer has 7 days to provide evidence of ability to close. If the evidence is not provided, the Seller can notify the Buyer that the Buyer is in breach. The Buyer then has a 3-day cure period. Absent a cure, the Seller can terminate the contract.

This is an important protection for the Seller. First, Sellers generally need to move. Many are reluctant to start the moving process without assurance that the sale is moving forward. Second, the Seller really doesn’t have another way to protect himself if the buyer isn’t showing signs of progress toward closing. In this extraordinary market, buyers do extraordinary things. Holding a property off the market and risking a loss of earnest money is, unfortunately, a possibility. Types of Evidence of Ability to Close

What if there is no Finance Contingency? In this hot Seller’s market, buyers are waiving their right to a finance contingency. Often, the finance contingency is still included with the contract, but with zero days in the finance contingency. Therefore, the Seller’s right to demand evidence of ability to close and the right to terminate are in place. However, if there is no finance contingency at all, it is important to include an All Cash Sale exhibit in the contract. The All Cash Sale exhibit includes a verification of funds by the Buyer and the right of the Seller to terminate if the Source of Funds evidence is not sufficient or timely. Sometimes we see a simple Special Stipulation that the sale will be all cash, with neither a finance contingency nor an All Cash Sale exhibit included. Unless there is an anticipatory breach by the Buyer, the Seller has no way to terminate prior to closing day, if he is not satisfied that the Buyer has the funds to move forward. |

RMAAReal Estate News, Brokers Blog & More Categories

All

Archives

July 2024

|

RSS Feed

RSS Feed