|

Recently, we have been faced with condominium associations that cannot be approved by lenders for Fannie Mae and Freddie Mac loans due to deferred maintenance, financial and insurance deficiencies, and other HOA issues. After the terrible condominium collapse last year in Florida, Fannie Mae and Freddie Mac created additional conditions to the HOA Approval process. Significant deferred maintenance at the Florida condominium was a factor in the building collapse. Property management of condominiums are now required to answer additional questions regarding deficiencies, defects, substantial damages and deferred maintenance, as well as other new questions. Protect Your Condominium Buyer Clients To protect a buyer’s earnest money in the event that the approval process takes longer than the time limits of finance contingency or if the HOA cannot be approved at all, we recommend adding a Special Stipulation to all condominium purchase agreements that allows the buyer to terminate if the property cannot be qualified by FNMA or Freddie Mac. If such a stipulation is not included and the HOA is not approved by the lender, there is no protection for the buyer after the finance contingency has expired. The following is a new Special Stipulation released by GAR for this situation. Note that the GAR Special Stipulation calls for the buyer’s termination right based on a number of days from the binding date. The time period can, of course, be adjusted as the situation requires. We suggest that instead of days from binding that the time period be written as any time prior to closing. Both variations are below: GAR SS 528 CONTINGENCY FOR RECEIVING CONDOMINIUM QUESTIONNAIRE If the Property is a condominium unit, and if the Buyer is obtaining a loan to purchase the Property, this Agreement shall be contingent upon the condominium in which the unit is located being eligible for financing and approved by Buyer’s lender. If Buyer obtains written notice from Buyer’s lender indicating that (1) it is declining Buyer’s loan application because the condominium in which the unit is located is ineligible for financing or (2) Buyer’s lender is unable to determine whether the condominium in which the unit is located is eligible for financing because the HOA or management company for the condominium has not provided sufficient information for the lender to make such a determination, then Buyer may terminate this Agreement by providing written notice to Seller, along with the notice from Buyer’s lender, within ____ days from the Binding Agreement Date. If Buyer timely provides such notice, then Buyer shall be entitled to the return of their earnest money. If Buyer does not timely provide such notice, then the contingency contained in this paragraph shall be waived and of no further force or effect. This contingency is applicable irrespective of whether there is any loan, financing, or all cash, contingency exhibit attached hereto and shall survive the expiration, wavier, or satisfaction of the same. RMAA CONTINGENCY FOR CONDOMINIUM HOA INELIGIBLE FOR FINANCING If the Property is a condominium unit, and if the Buyer is obtaining a loan to purchase the Property, this Agreement shall be contingent upon the condominium in which the unit is located being eligible for financing and approved by Buyer’s lender. If Buyer obtains written notice from Buyer’s lender indicating that (1) it is declining Buyer’s loan application because the condominium in which the unit is located is ineligible for financing or (2) Buyer’s lender is unable to determine whether the condominium in which the unit is located is eligible for financing because the HOA or management company for the condominium has not provided sufficient information for the lender to make such a determination, then Buyer may terminate this Agreement by providing written notice to Seller, along with the notice from Buyer’s lender, at any time prior to closing. If Buyer timely provides such notice, then Buyer shall be entitled to the return of their earnest money. If Buyer does not timely provide such notice, then the contingency contained in this paragraph shall be waived and of no further force or effect. This contingency is applicable irrespective of whether there is any loan, financing, or all cash, contingency exhibit attached hereto and shall survive the expiration, wavier, or satisfaction of the same.

0 Comments

The new GAR Contract forms will drop on January 1, 2023. The new year also comes

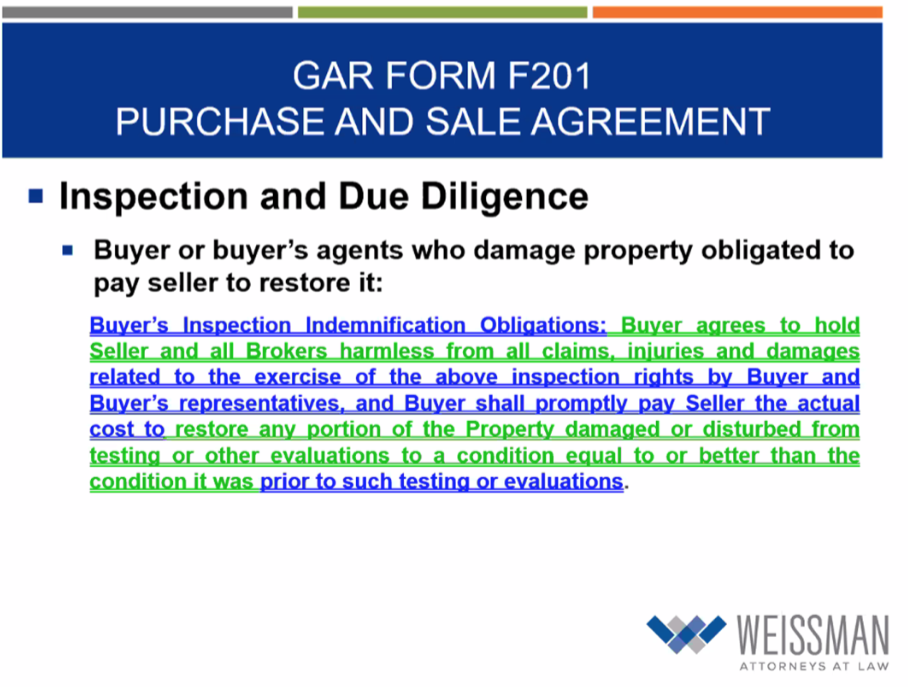

with a few changes to the Listing Agreement. Lead Based Paint Exhibit To Be Attached to the Listing Agreement. The Lead Based Paint Exhibit should now be added to the Exclusive Seller Brokerage. Engagement Agreement (Listing Agreement) if the property or any portion of it was built prior to 1978. The new language gives the seller a place to disclose whether the dwelling or any portion thereof was built prior to 1978. It also alerts the seller that federal law requires the disclosure of lead-based paint in homes constructed prior to 1978. Language Added Regarding Brokers Who are Not Members of an MLS. This language was also added to the brokerage engagement: “Seller’s broker shall have no obligation to pay any cooperating broker who is not a participant of the Multiple Listing Service(s) in which the Property is listed a commission unless cooperating broker has negotiated and executed with the seller’s broker a Co-op Commission Agreement.” Offers of compensation set forth in a multiple listing service have always been limited to other members of the Multiple Listing Service. However, this new language was added since many REALTORS® are unaware of the fact. In order to be protected, non-participants of a multiple listing service should negotiate their commission with the seller’s broker prior to showing the property. Obligation of Sellers to Disclose Known Latent Defects Clarified. This section of the brokerage engagement agreement explains to sellers that they have a duty to disclose latent defects. For 2023, clarifying language was added that the disclosure obligation only requires the disclosure of “known” latent defects. The clarifying language was added to both the exclusive and non-exclusive forms. Change to 2023 GAR Purchase and Sale Agreement. Who pays for damage done during inspection?12/15/2022 A buyer is allowed to inspect property right up to the closing day, even if there is no due diligence period or the property is sold in an “as is” condition. If there is damage to the property during an inspection, who is responsible for restoring the property?

The 2023 GAR Purchase and Sale Agreement has clarified the situation by adding “Hold Harmless” language. That is, the buyer or the buyer’s agents who damage property are obligated to pay the seller to restore it. However, the seller can pay for the restoration., but the buyer is required to reimburse the seller. That is, the buyer holds the seller harmless. Inspector may be insured In many cases, the inspector has caused the damage. An inspector will put holes in stucco looking for moisture, remove sheetrock looking for mold, run faucets and forget to turn them off and even step through the attic floor to the ceiling below. Most inspectors do have liability insurance that pays for damage to the property. It is recommended that the seller ask the inspector for proof of liability insurance prior to proceeding with an inspection. In the case of a septic tank inspection, consider including a special stipulation that requires the buyer to restore any landscape disturbance in addition to the any land disturbance at the septic tank site. It can be difficult to get a buyer to restore shrubs, flower beds and other landscaping that may be damaged. Updated language: Lease Purchase Agreements have been explored in previous Broker Corners.

The emphasis in this Broker Corner is the distinction between the earnest money that accompanies the purchase agreement and the security deposit that accompanies the lease. The 2 amounts are disbursed differently. Earnest money is disbursed according to the terms of the purchase agreement. If the sale closes, the earnest money is applied to the purchase price. However, if the buyer defaults and the sale does not close, earnest money is forfeited to the seller. A security deposit, on the other hand, is returned to the tenant if the lease ends without damage or outstanding rent or other costs. Don’t Allow a Buyer to Occupy Property Until These 3 Items Have Been Completed The point of a lease purchase is that the buyer be allowed to move into the property prior to a closing. That said, the buyer should not be allowed to occupy until 3 things have happened: 1. The earnest money is paid and has cleared (confirm if the co-op is the Holder). Should the buyer default, the earnest money is the seller’s sole remedy. 2. A move in agreement has been executed by both parties. Without a move in agreement, the landlord/seller’s right to the security deposit is compromised. 3. The lease security deposit has been paid. Should the buyer not pay the rent, not close the sale and damage the property, the security deposit is the landlord/seller’s remedy on the lease. What If the Buyer is in Default of the Purchase and Sale Agreement? The tenant is obligated to purchase at the end of the lease term, which coincides with the closing date of the Purchase and Sale Agreement. If the tenant/buyer does not close the purchase by the closing date, the tenant is in default, the seller can terminate the purchase agreement and the buyer forfeits the deposited earnest money. The lease also terminates upon the termination of the purchase agreement and the buyer/tenant must vacate the property upon the owner’s demand. What Happens to the Security Deposit? The disbursal of security deposit operates just like a standard lease. It is returned to the tenant if the lease ends without damage or outstanding rent or other costs. Seller Versus Buyer Representation It is generally better for the seller to have a larger earnest money deposit than security deposit. If the buyer defaults, the seller keeps the earnest money, but not necessarily the security deposit. If you are representing the buyer, you might offer the opposite. What happens when a seller of property executes a contract in the wrong capacity?

Individual Property Owners If an individual is buying or selling a piece of property, the individual should execute the sales contract by signing just his name. Parties will sometimes, though, sign a contract in the wrong capacity. For example, if a seller owns a property personally, but he signs a purchase agreement as though the seller is the corporation of which he is president, then the contract is unenforceable. The corporation didn’t own the property, making that signature invalid. The owner didn’t sign the contract personally or individually. There is not a valid signature. If the parties don’t want to correct the mistake, or one (or both) of the parties does not want to move forward, the contract is unenforceable. Authorized Agents or Representatives If a corporation or some other entity owns the property, the person signing the contract on behalf of the company must reflect that representative capacity in the signature block of the contract. Authorized representatives may sign on behalf of corporations, partnerships, limited partnerships, and limited liability companies. Typically, the closing attorney in such a transaction will want a copy of the legal documents for the entity or a corporate resolution confirming the authority of the person to act in a representative capacity. Executors, Administrators, Trustees and Guardians Contracts signed by executors, administrators, trustees and guardians must identify the capacity in which a person is signing. The representative must name the person or entity being represented on the face of the contract and show that they are signing the contract in a representative capacity. If the representative relationship is not clearly disclosed on the contract, the contract could be enforced against the individual acting as the agent, representative, trustee, or guardian and not against the person or entity being represented. Persons Whose Names Have Changed Generally, when a seller’s name on the purchase and sale agreement is different from how it appears on the deed recorded in the land records, a closing attorney will require the seller to bring to the closing for verification her marriage license, divorce decree, or other official name-changing document, and a photo identification reflecting the seller’s new name. Once the name change is verified, a name affidavit stating that the named persons are one and the same is included in the recital section of the property deed. Lastly, closing attorneys generally require that the seller sign the deed and purchase and sale agreement with the new legal name, followed by “formally known as [or f.k.a.] _____________ [previous legal last name].” The sample signature block set forth below may be used to indicate a name change: Seller: /s/ Sally Smith Jones Sally Smith Jones, f.k.a. Sally Smith Using a Power of Attorney An individual who has been given a power of attorney may sign a contract on behalf of any individual party who has the capacity to enter into a contract. Since a contract for the sale of land must be in writing, the power of attorney giving someone the authority to sign a real estate contract on someone else’s behalf also must be in writing. Georgia law also requires that the power of attorney be signed and sealed by a notary public and separately witnessed if the power of attorney is being given to buy or sell land. Generally, a power of attorney to sign a contract is executed before a party signs a real estate agreement on behalf of an absent party. However, in some rare instances, a party who is not authorized to sign an agreement will do so on behalf of an absent party without a power of attorney. If such an instance occurs, the contract will generally be void and unenforceable because the signatory did not have the proper authority to consummate the transaction. However, the party with the proper authority may ratify the contract after it has been signed by creating a power of attorney with a retroactive effect. Normally, in closing real estate transactions, the closing attorney is going to ask for the documents evidencing the power of attorney’s authority to execute the agreement on behalf of the absent party and recommended practice is for a party to grant the representative a formal power of attorney that expressly empowers the representative to execute a sales contract for a particular piece of property. If such a power of attorney is executed, the terms of the power of attorney should describe the property with the same specificity as the contract itself. Although the power of attorney may include only a general description of the property, title insurance companies are reluctant to accept such general authority for a representative to act. Nevertheless, it is best if the power of attorney state that the representative has the express power to sign mortgage loan documents, if this is going to be the case. Lenders and title insurance companies may have their own preferred form for powers of attorney and require that they are used. While any legally enforceable power of attorney should do, it may make the transaction smoother to first check with the lender’s closing attorney or title insurance company to determine if they have a preferred form. Consequences of an Insufficient Power of Attorney A party who signs a contract based on an insufficient or ineffective power of attorney is not bound to the contract. Individuals who deal with representatives in real estate contracts should carefully examine the representative’s authority to act. If there is a written power of attorney, the party giving the power of attorney should be contacted, if possible, to confirm its authenticity. The parties may also attach a copy of the power of attorney to the sales contract. A power of attorney must be effective at the time it is being exercised. If the power of attorney is very old, it is best to verify that it is still valid. The power of attorney must be signed by the property owners of record. Further, the power of attorney must contain a provision that allows the agent to execute a deed of transfer of ownership to the property as well as the power to negotiate the terms of the sale. A power of attorney terminates by express revocation, by the appointment of a new agent, or by the death of the principal or agent. If a person acting in a representative capacity signs a contract based on a power of attorney and the power of attorney does not actually give the representative the authority to enter into the contract, the other party to the contract cannot sue the representative for a breach of authority if that other party could have protected himself by taking ordinary care, such as reviewing the power of attorney or contacting the party who gave the power of attorney. Source: Weissman, Seth. The Red Book on Real Estate Contracts in Georgia (pp. 299-307). BookBaby. Kindle Edition. |

RMAAReal Estate News, Brokers Blog & More Categories

All

Archives

July 2024

|

RSS Feed

RSS Feed