|

Situation:

Broker A has a valid Buyer Brokerage Agreement with an individual Buyer. Broker A and the Buyer view a property together with Broker B, representing the Seller. The Buyer submits an offer on the property, but withdraws it before the offer is accepted. Later, while the Buyer Brokerage Agreement is still in effect, Buyer crates an LLC with a partner and submits a 2nd offer to purchase the same property. The Buyer’s Broker is not included in the new transaction. The transaction closes with the new LLC, of which the Buyer is a Member. The Buyer is at the closing and signs the security deed. Questions:

Buyer as a Legal Entity and Commission Owed to Buyer’s Broker The Buyer Brokerage Agreement at paragraph 7(f) includes the Buyer as follows: "Any legal entity in which buyer or any member of Buyer's immediate family owns or controls, directly or indirectly, more than ten percent (10%) of the shares or interest." Where the buyer changes its legal entity to another either to avoid its obligation or innocently, the Buyer is still obligated on a Buyer Brokerage Agreement that is still in effect. No, the Buyer cannot avoid its obligation to the Buyer’s Broker by changing its legal entity so long as the Buyer owns more than 10%. And yes, the Buyer continues to owe a commission to the Buyer’s Agent. It may take legal action to recover the commission, but it is owed. The Listing Agent’s Obligations REALTORS® have an affirmative obligation to ask prospects whether they are a party to any exclusive representation agreement and may not knowingly provide substantive services concerning a prospective transaction to prospects who are parties to exclusive representation agreements. In this case, the Seller’s agent was fully aware of the original buyer, having shown the property to the buyer previously, along with the Buyer’s agent. Even if the Seller’s agent thought the Buyer Brokerage has expired or was terminated, the listing agent should have investigated. Had he called the Buyer’s agent he would have learned that the Buyer Brokerage was still in effect. He violated both Georgia License Law and the REALTORS® Code of Ethics. (GA Code § 43-40-25 (14) and § 43-40-25 (26), REALTORS® Code of Ethics Standard of Practice 16-9)

0 Comments

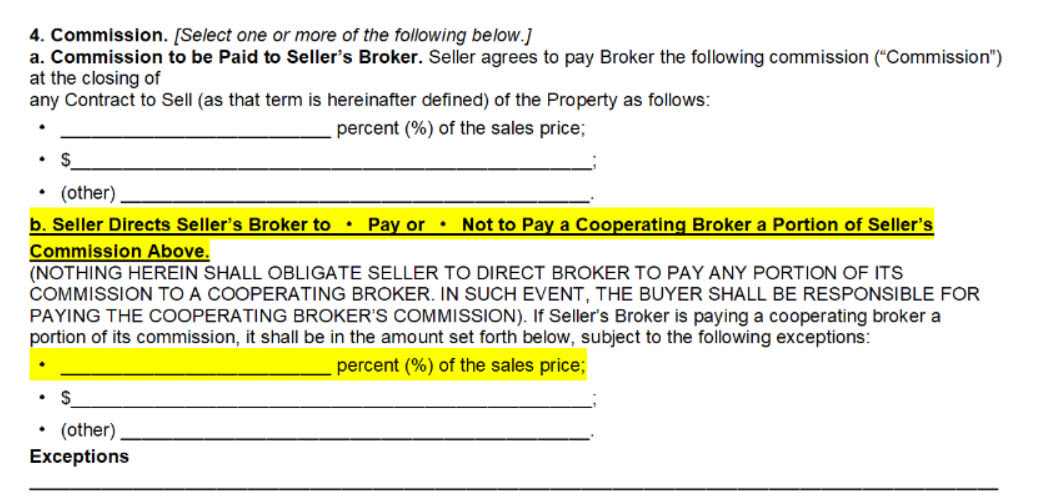

COMMISSION SECTION OF SELLER BROKERAGE ENGAGEMENT AGREEMENT To complete the commission section of the seller brokerage engagement agreement, it is required that one of the boxes is marked in paragraph 4.b. (highlighted below). This section should indicate if the Seller Directs Seller’s Broker to Pay or Not to Pay a Cooperating Broker a Portion of the Seller’s Commission. We are seeing this section left blank, but it needs to indicate one or the other. 4. Commission. [Select one or more of the following below.] a. Commission to be Paid to Seller’s Broker. Seller agrees to pay Broker the following commission (“Commission”) at the closing of any Contract to Sell (as that term is hereinafter defined) of the Property as follows: * __________________________ percent (%) of the sales price; * $__________________________________________________; * (other) _____________________________________________. b. Seller Directs Seller’s Broker to * Pay or * Not to Pay a Cooperating Broker a Portion of Seller’s Commission Above. (NOTHING HEREIN SHALL OBLIGATE SELLER TO DIRECT BROKER TO PAY ANY PORTION OF ITS COMMISSION TO A COOPERATING BROKER. IN SUCH EVENT, THE BUYER SHALL BE RESPONSIBLE FOR PAYING THE COOPERATING BROKER’S COMMISSION). If Seller’s Broker is paying a cooperating broker a portion of its commission, it shall be in the amount set forth below, subject to the following exceptions: * __________________________ percent (%) of the sales price; * $__________________________________________________; * (other) _____________________________________________. Exceptions _____________________________________________________________________________________________ Section 4.d in the GAR buyer brokerage engagement agreement lays it out. The Protected Period is the period of time commencing upon the expiration or earlier termination of this Agreement by Buyer in writing during which Broker shall be protected for its Commission. The Protected Period is the number of days remaining on what would have been the original agreement as of the date the Buyer terminates the Agreement plus the number of days set forth as the Protected Period in Section 4.d of the buyer brokerage engagement agreement.

The GAR Exclusive Buyer Brokerage Engagement Agreement provides that the broker is entitled to a commission, if the buyer purchases or contracts to purchase, for a period of time after the termination or expiration of the brokerage agreement, a property identified or shown to the buyer by the broker or about which the broker provided information to the buyer during the brokerage agreement. While the terms “identified” and “shown” are not defined, the terms were intended to protect brokers in situations where the buyer learned of the property through the broker’s efforts. The language allowing a broker to collect a commission if the buyer purchased property based on information the broker provided to the buyer accomplishes the same goal. As such, it is not required that the broker actually show the property to the buyer, provided that the broker has taken other reasonable steps to make the buyer aware of the property. Verbiage from the GAR Buyer Brokerage Engagement Agreement: 4.d The Protected Period shall be the period of time set forth in this Agreement commencing upon the expiration of this Agreement or what would have been the expiration of this Agreement had it not been unilaterally terminated by Buyer during which Broker shall be protected for its Commission and/or Leasing Commission, as applicable. There shall be no Protected Period if Buyer and Broker mutually terminate this Agreement. In the event Buyer enters into a Contract to Purchase or lease, lease to purchase or lease with an option to purchase of real property which, during the term of this Agreement or what would have been the term of this Agreement had it not been unilaterally terminated by Buyer, was shown to Buyer by Broker, either virtually or in person, or which Buyer otherwise visited ("Protected Properties"), then Buyer shall pay Broker at closing or prior to the commencement of the lease the Commission and/or Leasing Commission, as applicable, set forth above. It’s not uncommon for a couple going through a divorce to need to sell their home. As a real estate professional, you may find yourself involved in transactions where the sellers are navigating divorce. In those cases, do you need to disclose that the sellers are getting divorced?

You are not required to disclose your client’s personal reasons for selling or personal information that doesn’t affect the material value of the home. In addition, disclosing the divorce could be a breach of your obligation to keep their personal information confidential. It could suggest to a buyer that the sellers might accept a lower price. When handling divorcing sellers, it’s essential to recognize that their goals and interests may not always align. As a real estate agent representing both parties, this presents a unique challenge because you have a responsibility to both individuals. Make sure to protect yourself and take extra precautions.

If your sellers have legal questions regarding their divorce, make sure to direct them to their attorney. Injuries to potential buyers and brokers while viewing property are not uncommon. This article explores the liability of owners to invitees to a resale property and to houses under construction.

Open Houses and Showings Homeowners are generally responsible for exercising reasonable care to make a property safe for those invited onto it. This general duty to make a property reasonably safe includes repairing dangerous conditions that are known or could be reasonably discovered by the homeowner or warning guests of their existence. Comparative Negligence However, to recover for an injury suffered on and because of someone else’s property, the injured party must have been exercising “ordinary care” when they were nonetheless hurt. Georgia common law follows a modified comparative theory of negligence, where the law aims to place the burden of an injury on the party best situated to have avoided it. In other words, an injured party can only recover damages for an injury if the party was comparatively less at fault for the injury than the person being sued. The law only requires that the owner or occupier of land ensure that the property is safe enough that a person who does manage to hurt herself is comparatively more to blame for her injury than the owner or occupier of the land. Does a property owner owe a special duty to someone who may come on to listed real estate solely because of having seen a “For Sale” sign. This issue came up recently in two separate instances in which homes were listed for sale and “For Sale” signs were placed in the yards. Two different buyers saw the signs and decided to walk onto the properties on their own to have a look around. Both suffered significant injuries when, for one a deck, and for the other a stairway fall. They both sued, claiming that the owners owed them a duty to warn about the defective conditions; even though the owners had no idea these prospects were on the properties. As if often the case, there are two appellate decisions in Georgia addressing similar issues, both of which reach opposite conclusions. The safest course is for owners to post warnings or rope off areas of the property that might be unsafe, no later than when a “For Sale” sign is placed on their property. Liability of Agents and Affiliated Agents for Not Exercising Reasonable Care Some states hold brokers personally liable for injuries suffered by those viewing a property if the broker or affiliated agent failed to exercise reasonable care to make a property safe for those invited onto it. Although Georgia has not done so, Georgia courts may well do so in future. Listing Brokers Should Visually Inspect and Recommend Repair of Hazards To be protected from this potential liability, listing agents should perform a thorough visual inspection of the property before inviting anyone to view it. If any potentially hazardous conditions are identified during this inspection, the listing agent should then require the seller to make all such hazards reasonably safe in light of their foreseeable future uses. The owner should be encouraged to fix all of these issues prior to inviting potential buyers onto the property, to ensure that no liability arises. Brokers should perform this preliminary inspection for hazards irrespective of any disclosures or promises of the owner, as the “duty to inspect” is imposed on the owners and probably includes sellers’ brokers and their affiliated licensees. (Georgia courts have ruled both ways.) A broker or owner is not required to discover nor disclose every possible latent defect in the property during this inspection. Instead, he must exercise “reasonable care” to make the property safe in light of the foreseeable use thereof. Examples of potential hazards to look for during this initial inspection include things like rotten stair treads or decking, broken or loose railings or burned-out lights, loose carpet or hanging fixtures, tripping hazards such as uneven sidewalks, exposed wires, and any other conditions on the property that could foreseeably lead to injury. Warning About Any Lingering Dangers In addition to performing a thorough inspection for dangerous conditions, brokers should make sure to give enough warning about any lingering dangers the owner neglects to fix so that those invited onto the property can easily avoid those dangers. If, for example, before an open house a broker notices that a two-story deck has rotten floorboards, that broker should make certain that no one who attends the open house goes out on the deck, or if the buyer is insistent, at least does not go without first being warned of the potential danger. The broker could communicate the warning in several ways, including posting a written sign, verbally warning potential buyers, physically restricting access to the deck by closing the deck off entirely, or doing all of the above. Perhaps the easiest way for brokers to limit their liability in this situation is to provide a written disclosure listing all known latent dangers to each prospective buyer and require each such buyer to sign it immediately before they enter the property. While not the most positive sales technique (except in the case of extreme “fixer-upper” properties where buyers may be enticed by a laundry list of defects), if any injury does result there is written proof that the broker exercised ordinary care by warning the victim of the danger beforehand, and that the victim was probably not exercising ordinary care since he or she clearly ignored that warning. A sample of this type of disclosure is as follows: The undersigned prospective buyers acknowledge that they have been informed of the following dangers and agree to use extreme care to avoid these potentially hazardous conditions: [LIST OF KNOWN DEFECTS]. The previous items are not meant to be an exhaustive list of all dangerous conditions on the property, but rather are those known to the owner/broker based on a visual assessment of the property. Houses Under Construction Houses that are under construction present a heightened risk of injuries. Most builders will not let buyer’s tour homes under construction until the house is almost complete to avoid the risk of claims. If tours are allowed, prospects and buyers are generally required to have a builder or builder representative on the tours. Remember that Georgia is a comparative liability state. If a prospect or a broker goes onto a property without permission, that person may not be able to recover for an injury. That is, the injured party may be more at fault than the owner. Reference: Weissman, Seth. The Red Book on Real Estate Contracts in Georgia (pp. 60-65). BookBaby. Kindle Edition. In Georgia, the distinction between real property and personal property is essential in real estate transactions:

Examples of Real Property:

Examples of Personal Property:

As you are likely aware, on January 27th Fulton County fell victim to a ransomware attack. The attack shut down phone lines and computer systems leaving everyone unable to access the court civil records, probate records, water billing systems, and the Fulton County Tax Commissioner website. This is not an exhaustive list of everything that has been affected as experts are still working to repair the damage. The good news is that government officials are reporting that the hacker group responsible for the attack has been shut down. The bad news is that cyber security experts are now working on their own to assess and repair the damage done.

How does this affect you and your clients you may ask? For the foreseeable future, sellers are going to be required to provide the relevant information needed to clear title. Because there is no way to access the tax records, the civil records, the probate records or the water bill records, sellers now have to provide satisfactory proof. However, this may not be the case with every law firm. Not every law firm is able to close transactions in Fulton County if their title underwriters are not confident in the law firms ability to get and evaluate the information appropriately. We, at Campbell and Brannon, have been able to use our good standing with our title insurance companies to allow our Fulton County deals to close. Many law firms are not able to do this as their risk profile with the title underwriters is not as strong as ours. Each title company has a slightly different list of requirements but the basics are as listed below.

The contract covers the buyers already as it puts the onus on the seller to provide all the information that closing attorneys require/ask for in order to clear title. If the sellers are unable to do so, they are in default. If you want to add a stipulation to your contract to further protect your buyers, we recommend something like: “Seller agrees to cooperate and promptly provide all information requested from the closing attorney. Should the seller fail to promptly provide this information resulting in a delay or inability to close on time, then buyer shall have the right to terminate the agreement without penalty and receive a full refund of the earnest money.” Unfair trade practices are those using deceptive, fraudulent, or unethical means to obtain business. Licensees should view Georgia Code 43-40-25 as an expected code of conduct to protect the public and licensees' professional reputation. Licensees should know the law and avoid any violations, which could result in license suspension or license revocation.

License suspension is a temporary loss of license where it's made inactive as a penalty of a violation. Revocation is an indefinite loss of license where it's stripped from the license holder to prevent that person from ever practicing real estate again. Licensees shall not engage in any of the following:

An interpleader is generally thought of as a situation where two parties are both claiming the same money being held by a third party where the third party has no claim to the funds but is unsure which of the two parties is entitled to the funds. In such an instance, the party holding the funds can sue both claimants, deposit the funds into the registry of the court and ask the judge to decide who is entitled to the funds. Interpleader actions are often filed by real estate brokers when earnest money disputes cannot be resolved. (garealtor.com FAQs)

If the real estate broker who is the holder of the earnest money cannot get the parties to agree and cannot make a reasonable decision based on the terms of the Purchase Agreement and the facts, an interpleader action can be filed, and the funds are deposited with the appropriate court. The court then makes the disbursement decision. An interpleader is costly and time consuming. It should be used as a last resort. The threat of an interpleader can spur an agreement between the parties. You can't tell the difference between a Condo and a Townhome just by looking at them. It's not style, design, or physical characteristics that determine the answer. It's an OWNERSHIP ISSUE.

To determine if a townhome is fee simple or condominium ownership, you should ask for a copy of the community’s legal documents. If it is a fee simple townhome, the first page of the legal documents will typically be written as declaration of covenants, conditions, and restrictions (CCR’s) or something similar. If the property is condominium ownership, the first page will always say declaration of condominium. What is the difference between Fee Simple and Condominium ownership? 1) FEE SIMPLE “The largest, most complete bundle of rights one can hold in land and land ownership.” If the property is a fee simple townhome, the townhome is a part of a community where the property has been subdivided so the property owner owns the lot and the townhome that sits on the lot. Even though townhomes have common walls, fee simple ownership is very similar to a single-family home. In fee simple ownership, typically the owner is responsible for maintenance of the exterior walls, roof, and yard. 2) CONDOMINIUM “Individual ownership of a space of air plus undivided ownership of common areas.” A condominium is not a subdivision of real property. Basically, the title holder owns everything inside the interior walls. From the exterior walls out is owned by all owners as one body. Each homeowner has a share of the common areas. All exterior maintenance and upkeep of the grounds is usually managed by the HOA or board. It is important to know the type of ownership of a property prior to listing the property or representing a buyer on a purchase. As a Listing Agent, you should request that sellers provide copies of the tax bill, survey (if one exists), the community’s legal documents, name & contact information for the HOA and/or property manager, and the property’s legal description. As a Buyer’s Agent, you should review the listing for the property type and HOA dues. You should also do extra due diligence to confirm the type of ownership. It may be easier for a buyer to obtain mortgage financing on a simple townhome than it is on a condominium. For condominiums, underwriters typically have more guidelines and regulations. The buyer will need to go through the process of qualifying as a borrower and the lender also needs to confirm that the condo is approved. |

RMAAReal Estate News, Brokers Blog & More Categories

All

Archives

July 2024

|

RSS Feed

RSS Feed